CA Course

Chartered Accountancy

The CA course (Chartered Accountancy course) is a professional qualification that prepares individuals to become certified Chartered Accountants. CA course encompasses comprehensive training in accounting, auditing, taxation, financial management, and related areas. CA course typically involves a series of examinations, practical training, and sometimes additional coursework, which are designed to ensure proficiency in various aspects of financial and business management. In a dynamic and challenging business environment, Chartered Accountants are looked upon as Complete Business Solution Providers. They are thoroughly trained practically in all avenues of Finance, Accounting, Auditing, Taxation and International Tax Laws.

In India, the ICAI conducts CA exams and certifies a candidate as a qualified Chartered Accountant on successful completion of the three-level course. Examinations that are conducted during the Chartered Accountancy course are:

- CA Foundation Examination (earlier known as Common Proficiency Test or CPT)

- CA Intermediate (Integrated Professional Competence or IPC) Examination

- CA Final Examination

CA Course Prospectus:

https://resource.cdn.icai.org/75086bos60514-icai-prospectus-new.pdf

Syllabus

- CA Foundation:

https://resource.cdn.icai.org/74845bos60515-foundation.pdf

- CA Intermediate:

https://resource.cdn.icai.org/74847bos60515-intermediate.pdf

- CA Final

https://resource.cdn.icai.org/74844bos60515-final.pdf

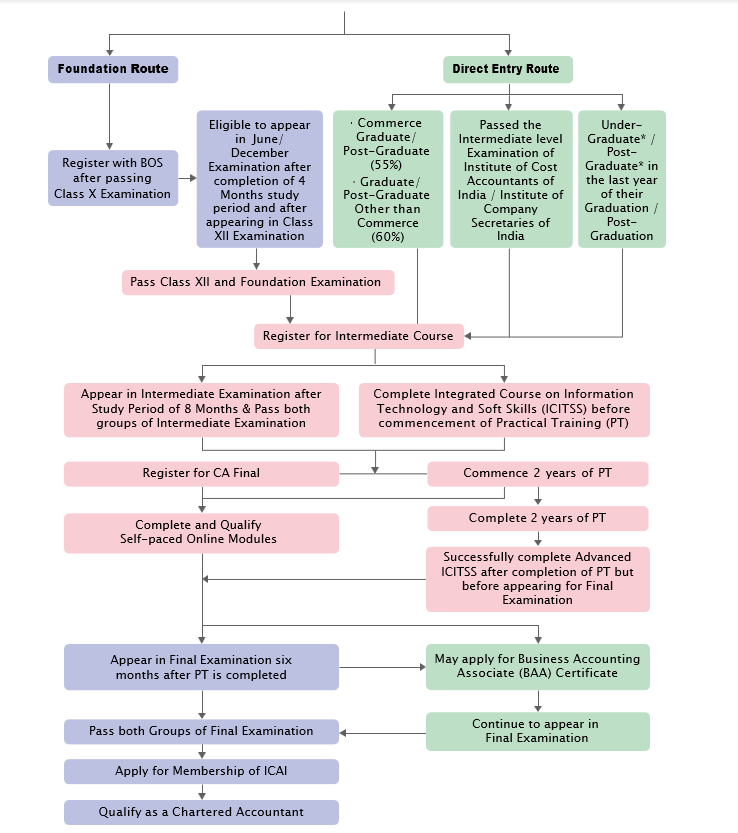

EDUCATION AND TRAINING AT A GLANCE

* On submission of final year graduation/post-graduation mark sheets, with prescribed minimum marks, the provisional registration will be confirmed.

CA Foundation Course:

There are 4 papers in Foundation Course which are as under:

Paper 1: Accounting (100 marks)

Paper 2: Business Laws (100 marks)

Paper 3: Quantitative Aptitude (100 marks)

- Business Mathematics

- Logical Reasoning

- Statistics

Paper 4: Business Economics (100 marks

(Paper 1 & 2 are subjective type and Paper 3 & 4 are objective type. There is negative marking of 0.25 mark for every wrong answer in objective type papers.)

CA Intermediate Course

There are 6 papers in Intermediate Course which are as under:

Group I

Paper 1: Advanced Accounting (100 marks)

Paper 2: Corporate and Other Laws (100 marks)

Paper 3: Taxation

- Section A – Income-tax Law (50 marks)

- Section B – Goods and Services Tax (GST) (50 marks)

Group II

Paper 4: Cost and Management Accounting (100 marks)

Paper 5: Auditing and Ethics (100 marks)

Paper 6: Financial Management and Strategic Management

- Section A – Financial Management (50 marks)

- Section B – Strategic Management (50 marks)

CA Final Course

There are 6 papers in Intermediate Course which are as under:

Group I

Paper 1: Advanced Accounting (100 marks)

Paper 2: Corporate and Other Laws (100 marks)

Paper 3: Taxation

- Section A – Income-tax Law (50 marks)

- Section B – Goods and Services Tax (GST) (50 marks)

Group II

Paper 4: Cost and Management Accounting (100 marks)

Paper 5: Auditing and Ethics (100 marks)

Paper 6: Financial Management and Strategic Management

- Section A – Financial Management (50 marks)

- Section B – Strategic Management (50 marks)